-

Invoice Type Code: 388 (Standard Invoice with advance adjustment)

-

Linked advance payment invoice Type Code: 386 (Prepayment)

-

XML is the same for both PDF layouts and follows ZATCA rules:

-

<cbc:PrepaidAmount>is 5750.00 (SAR) -

<cbc:DocumentReference>links to the advance invoice (Type Code 386) -

VAT amounts are correct in XML

-

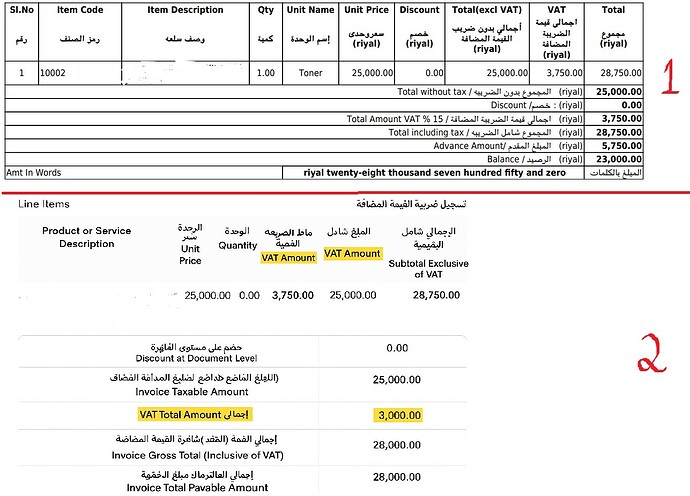

Layout 1 (Client’s previous format – understandable):

-

Shows Line Total excl. VAT: 25,000.00 SAR

-

VAT @ 15%: 3,750.00 SAR

-

Total incl. VAT: 28,750.00 SAR

-

Advance Amount: 5,750.00 SAR

-

Balance Payable: 23,000.00 SAR

-

This clearly shows calculation:

(Total incl. VAT – Advance) = Balance.

Layout 2 (Client suggests – less clear):

-

Line shows VAT 3,750.00 SAR but in totals VAT is 3,000.00 SAR (due to advance adjustment).

-

Advance amount is not shown as a separate row — the VAT difference is embedded in the totals, making it less understandable to an end user.

My Question:

Both layouts are generated from the same ZATCA-compliant XML.

Does ZATCA require a specific PDF layout for advance adjustment, or is Layout 1 (clearer with amounts) also acceptable as long as the XML is correct?

XML snippet for reference:

<cbc:ID>INV0001</cbc:ID>

<cbc:UUID>11f1111a-a6e1-431c-a9a6-19vvvf85bg2c</cbc:UUID>

<cbc:IssueDate>2025-08-14</cbc:IssueDate>

<cbc:IssueTime>07:42:48</cbc:IssueTime>

<cbc:InvoiceTypeCode name="0100000">388</cbc:InvoiceTypeCode>

<cbc:Note languageID="ar">ABC</cbc:Note>

<cbc:DocumentCurrencyCode>SAR</cbc:DocumentCurrencyCode>

<cbc:TaxCurrencyCode>SAR</cbc:TaxCurrencyCode>

<cac:AdditionalDocumentReference>

<cbc:ID>ICV</cbc:ID>

<cbc:UUID>154</cbc:UUID>

</cac:AdditionalDocumentReference>

<cac:AdditionalDocumentReference>

<cbc:ID>PIH</cbc:ID>

<cac:Attachment>

<cbc:EmbeddedDocumentBinaryObject mimeCode="text/plain"></cbc:EmbeddedDocumentBinaryObject>

</cac:Attachment>

</cac:AdditionalDocumentReference>

<cac:AdditionalDocumentReference>

<cbc:ID>QR</cbc:ID>

<cac:Attachment>

<cbc:EmbeddedDocumentBinaryObject mimeCode="text/plain"></cbc:EmbeddedDocumentBinaryObject>

</cac:Attachment>

</cac:AdditionalDocumentReference>

<cac:Signature>

<cbc:ID>urn:oasis:names:specification:ubl:signature:Invoice</cbc:ID>

<cbc:SignatureMethod>urn:oasis:names:specification:ubl:dsig:enveloped:xades</cbc:SignatureMethod>

</cac:Signature>

<cac:AccountingSupplierParty>

<cac:Party>

<cac:PartyIdentification>

<cbc:ID schemeID="CRN">1111111111</cbc:ID>

</cac:PartyIdentification>

<cac:PostalAddress>

<cbc:StreetName>test street</cbc:StreetName>

<cbc:BuildingNumber>1111</cbc:BuildingNumber>

<cbc:PlotIdentification>2222</cbc:PlotIdentification>

<cbc:CitySubdivisionName>test Dist.</cbc:CitySubdivisionName>

<cbc:CityName>test city</cbc:CityName>

<cbc:PostalZone>11111</cbc:PostalZone>

<cac:Country>

<cbc:IdentificationCode>SA</cbc:IdentificationCode>

</cac:Country>

</cac:PostalAddress>

<cac:PartyTaxScheme>

<cbc:CompanyID>300111111111113</cbc:CompanyID>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:PartyTaxScheme>

<cac:PartyLegalEntity>

<cbc:RegistrationName>TEST NAME</cbc:RegistrationName>

</cac:PartyLegalEntity>

</cac:Party>

</cac:AccountingSupplierParty>

<cac:AccountingCustomerParty>

<cac:Party>

<cac:PostalAddress>

<cbc:StreetName>test street</cbc:StreetName>

<cbc:BuildingNumber>3333</cbc:BuildingNumber>

<cbc:PlotIdentification>1111</cbc:PlotIdentification>

<cbc:CitySubdivisionName>test district</cbc:CitySubdivisionName>

<cbc:CityName>test city</cbc:CityName>

<cbc:PostalZone>22222</cbc:PostalZone>

<cac:Country>

<cbc:IdentificationCode>SA</cbc:IdentificationCode>

</cac:Country>

</cac:PostalAddress>

<cac:PartyTaxScheme>

<cbc:CompanyID>311111111110003</cbc:CompanyID>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:PartyTaxScheme>

<cac:PartyLegalEntity>

<cbc:RegistrationName>STANDARD CUSTOMER SA</cbc:RegistrationName>

</cac:PartyLegalEntity>

</cac:Party>

</cac:AccountingCustomerParty>

<cac:Delivery>

<cbc:ActualDeliveryDate>2025-08-14</cbc:ActualDeliveryDate>

</cac:Delivery>

<cac:PaymentMeans>

<cbc:PaymentMeansCode>30</cbc:PaymentMeansCode>

</cac:PaymentMeans>

<cac:TaxTotal>

<cbc:TaxAmount currencyID="SAR">3750.00</cbc:TaxAmount>

</cac:TaxTotal>

<cac:TaxTotal>

<cbc:TaxAmount currencyID="SAR">3750.00</cbc:TaxAmount>

<cac:TaxSubtotal>

<cbc:TaxableAmount currencyID="SAR">25000.00</cbc:TaxableAmount>

<cbc:TaxAmount currencyID="SAR">3750.00</cbc:TaxAmount>

<cac:TaxCategory>

<cbc:ID schemeAgencyID="6" schemeID="UN/ECE 5305">S</cbc:ID>

<cbc:Percent>15.00</cbc:Percent>

<cac:TaxScheme>

<cbc:ID schemeAgencyID="6" schemeID="UN/ECE 5153">VAT</cbc:ID>

</cac:TaxScheme>

</cac:TaxCategory>

</cac:TaxSubtotal>

</cac:TaxTotal>

<cac:LegalMonetaryTotal>

<cbc:LineExtensionAmount currencyID="SAR">25000.00</cbc:LineExtensionAmount>

<cbc:TaxExclusiveAmount currencyID="SAR">25000.00</cbc:TaxExclusiveAmount>

<cbc:TaxInclusiveAmount currencyID="SAR">28750.00</cbc:TaxInclusiveAmount>

<cbc:PrepaidAmount currencyID="SAR">5750.00</cbc:PrepaidAmount>

<cbc:PayableAmount currencyID="SAR">23000.00</cbc:PayableAmount>

</cac:LegalMonetaryTotal>

<cac:InvoiceLine>

<cbc:ID>1</cbc:ID>

<cbc:InvoicedQuantity unitCode="Toner">1.000000</cbc:InvoicedQuantity>

<cbc:LineExtensionAmount currencyID="SAR">25000.00</cbc:LineExtensionAmount>

<cac:AllowanceCharge>

<cbc:ChargeIndicator>false</cbc:ChargeIndicator>

<cbc:AllowanceChargeReasonCode>95</cbc:AllowanceChargeReasonCode>

<cbc:AllowanceChargeReason>discount</cbc:AllowanceChargeReason>

<cbc:Amount currencyID="SAR">0.00</cbc:Amount>

</cac:AllowanceCharge>

<cac:TaxTotal>

<cbc:TaxAmount currencyID="SAR">3750.00</cbc:TaxAmount>

<cbc:RoundingAmount currencyID="SAR">28750.00</cbc:RoundingAmount>

</cac:TaxTotal>

<cac:Item>

<cbc:Name>LaserJet P2035 – CE505A-05A حبر اتش بى</cbc:Name>

<cac:ClassifiedTaxCategory>

<cbc:ID>S</cbc:ID>

<cbc:Percent>15.00</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:ClassifiedTaxCategory>

</cac:Item>

<cac:Price>

<cbc:PriceAmount currencyID="SAR">25000.0000</cbc:PriceAmount>

</cac:Price>

</cac:InvoiceLine> <cac:InvoiceLine>

<cbc:ID>2</cbc:ID>

<cbc:InvoicedQuantity unitCode="Toner">0.000000</cbc:InvoicedQuantity>

<cbc:LineExtensionAmount currencyID="SAR">0.00</cbc:LineExtensionAmount>

<cac:DocumentReference>

<cbc:ID>0225</cbc:ID>

<cbc:UUID>earfr7d64-51f3-4b6b-a932-6d557e6gh61c</cbc:UUID>

<cbc:IssueDate>2025-08-14</cbc:IssueDate>

<cbc:IssueTime>07:40:46</cbc:IssueTime>

<cbc:DocumentTypeCode>386</cbc:DocumentTypeCode>

</cac:DocumentReference>

<cac:TaxTotal>

<cbc:TaxAmount currencyID="SAR">0</cbc:TaxAmount>

<cbc:RoundingAmount currencyID="SAR">0</cbc:RoundingAmount>

<cac:TaxSubtotal>

<cbc:TaxableAmount currencyID="SAR">5000</cbc:TaxableAmount>

<cbc:TaxAmount currencyID="SAR">750</cbc:TaxAmount>

<cac:TaxCategory>

<cbc:ID>S</cbc:ID>

<cbc:Percent>15.00</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:TaxCategory>

</cac:TaxSubtotal>

</cac:TaxTotal>

<cac:Item>

<cbc:Name>LaserJet P2035 – CE505A-05A حبر اتش بى Prepayment</cbc:Name>

<cac:ClassifiedTaxCategory>

<cbc:ID>S</cbc:ID>

<cbc:Percent>15.00</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:ClassifiedTaxCategory>

</cac:Item>

<cac:Price>

<cbc:PriceAmount currencyID="SAR">0.00</cbc:PriceAmount>

</cac:Price>

</cac:InvoiceLine>

</Invoice>