every thing was fine in developer portal but in simulation portal i got one error

I am using .net sdk 3.3.5

load document

what i am missing

idaoud

September 24, 2024, 5:52am

2

Morning @sayedrahman

Thanks for reaching out,

Please note that “invoiceHash” in the request body must be the same Hash in the encoded invoice you are sending, as you can compare the “invoiceHash” from the body with the first “DigestValue” in the XML, they must be the same, otherwise, you will still receive the same error.

Thanks,

1 Like

eCloud

September 24, 2024, 6:36am

3

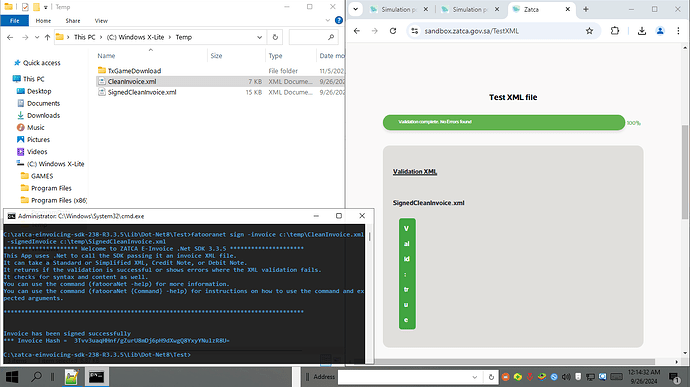

Create Clean Invoice

Load Document

Sign Document

Get RequestApi

Send to ZatcaServer.

I can inform you that Zatca.eInvoice.SDK .NET8 library works well for C# Application running on Windows Operating System.

It is interesting, if you use Zatca.eInvoice.SDK to sign Invoice, but you get Error as you mentioned.

Let me share my successful experience using Zatca.eInvoice.SDK to sign Invoice.

Regardless of how InvoiceXML is created, there are some things to notes in using Zatca.eInvoice.SDK to sign Invoice :

We do not need to add Signature and UBLExtension elements to Invoice XML, we only need to create clean invoice xml, the addition of UBL and Signature will be done by Zatca.eInvoice.SDK.

Make sure the Data\Rules\schematrons Folder along with the two xsl files in it are in our Project Directory . Zatca.eInvoice.SDK needs these two files in the Invoice signing process.

Make sure we use the correct Certificate, Decoded base64 CCSID binarySecurityToken for Compliance Check Invoice Api , and Decoded base64 PCSID binarySecurityToken for Clearance Api and Reporting Api.

Do not change the SignedInvoice generated by Zatca.eInvoice.SDK , we only need to create a RequestApi and send it to ZatcaServer.

In the case where we want to get QRCode, and InvoiceHash.

For QrCode we can take it from SignedInvoice without having to modify it.

And for InvoiceHash, we can get it on the RequestApi generated by Zatca.eInvoice.SDK.

I hope from this explanation you can get an idea for your project.

1 Like

Dear @eCloud

<?xml version="1.0" encoding="UTF-8"?>

cbc:ProfileID reporting:1.0</cbc:ProfileID>cbc:ID SME00010</cbc:ID>cbc:UUID 8e6000cf-1a98-4174-b3e7-b5d5954bc10d</cbc:UUID>cbc:IssueDate 2022-08-17</cbc:IssueDate>cbc:IssueTime 17:41:08</cbc:IssueTime>cbc:DocumentCurrencyCode SAR</cbc:DocumentCurrencyCode>cbc:TaxCurrencyCode SAR</cbc:TaxCurrencyCode>cac:AdditionalDocumentReference cbc:ID ICV</cbc:ID>cbc:UUID 10</cbc:UUID>cac:AdditionalDocumentReference cbc:ID PIH</cbc:ID>cac:Attachment

cac:AccountingSupplierParty cac:Party cac:PartyIdentification cac:PostalAddress cbc:StreetName الامير سلطان | Prince Sultan</cbc:StreetName>cbc:BuildingNumber 2322</cbc:BuildingNumber>cbc:CitySubdivisionName المربع | Al-Murabba</cbc:CitySubdivisionName>cbc:CityName الرياض | Riyadh</cbc:CityName>cbc:PostalZone 23333</cbc:PostalZone>cac:Country cbc:IdentificationCode SA</cbc:IdentificationCode>cac:PartyTaxScheme cbc:CompanyID 399999999900003</cbc:CompanyID>cac:TaxScheme cbc:ID VAT</cbc:ID>cac:PartyLegalEntity cbc:RegistrationName شركة توريد التكنولوجيا بأقصى سرعة المحدودة | Maximum Speed Tech Supply LTD</cbc:RegistrationName>cac:AccountingCustomerParty cac:Party cac:PostalAddress cbc:StreetName صلاح الدين | Salah Al-Din</cbc:StreetName>cbc:BuildingNumber 1111</cbc:BuildingNumber>cbc:CitySubdivisionName المروج | Al-Murooj</cbc:CitySubdivisionName>cbc:CityName الرياض | Riyadh</cbc:CityName>cbc:PostalZone 12222</cbc:PostalZone>cac:Country cbc:IdentificationCode SA</cbc:IdentificationCode>cac:PartyTaxScheme cbc:CompanyID 399999999800003</cbc:CompanyID>cac:TaxScheme cbc:ID VAT</cbc:ID>cac:PartyLegalEntity cbc:RegistrationName شركة نماذج فاتورة المحدودة | Fatoora Samples LTD</cbc:RegistrationName>cac:PaymentMeans cbc:PaymentMeansCode 10</cbc:PaymentMeansCode>cac:AllowanceCharge cbc:ChargeIndicator false</cbc:ChargeIndicator>cbc:AllowanceChargeReason discount</cbc:AllowanceChargeReason>cac:TaxCategory cbc:Percent 15</cbc:Percent>cac:TaxScheme cac:TaxCategory cbc:Percent 15</cbc:Percent>cac:TaxScheme cac:TaxTotal cac:TaxTotal cac:TaxSubtotal cac:TaxCategory cbc:Percent 15.00</cbc:Percent>cac:TaxScheme cac:LegalMonetaryTotal cac:InvoiceLine cbc:ID 1</cbc:ID>cac:TaxTotal cac:Item cbc:Name كتاب</cbc:Name>cac:ClassifiedTaxCategory cbc:ID S</cbc:ID>cbc:Percent 15.00</cbc:Percent>cac:TaxScheme cbc:ID VAT</cbc:ID>cac:Price cac:AllowanceCharge cbc:ChargeIndicator true</cbc:ChargeIndicator>cbc:AllowanceChargeReason discount</cbc:AllowanceChargeReason>cac:InvoiceLine cbc:ID 2</cbc:ID>cac:TaxTotal cac:Item cbc:Name قلم</cbc:Name>cac:ClassifiedTaxCategory cbc:ID S</cbc:ID>cbc:Percent 15.00</cbc:Percent>cac:TaxScheme cbc:ID VAT</cbc:ID>cac:Price cac:AllowanceCharge cbc:ChargeIndicator true</cbc:ChargeIndicator>cbc:AllowanceChargeReason discount</cbc:AllowanceChargeReason>

eCloud

September 25, 2024, 3:45pm

5

sayedrahman:

Well explanation, But at zatca signindocument said, QR tag also need to remove. Below is my xml which i am loading in the beginning. Can you tell me, Did i miss anything or add something unnecessary tag or line

Yes, if we don’t want to use Zatca.eInvoice.SDKsteps explained in this doc .

If we use Zatca.eInvoice.SDK library, we only need to focus on how to convert our ERP Invoice data into XML. All Signing steps described in the guide will be performed by Zatca.eInvoice.SDK

@idaoud

if you use Dotnet SDK

XmlDocument doc = new XmlDocument();doc.PreserveWhitespace = true;

2 Likes

@Abdulraouf

eCloud

September 25, 2024, 5:15pm

9

@sayedrahman

<?xml version="1.0" encoding="UTF-8"?>

<Invoice xmlns="urn:oasis:names:specification:ubl:schema:xsd:Invoice-2" xmlns:cac="urn:oasis:names:specification:ubl:schema:xsd:CommonAggregateComponents-2" xmlns:cbc="urn:oasis:names:specification:ubl:schema:xsd:CommonBasicComponents-2" xmlns:ext="urn:oasis:names:specification:ubl:schema:xsd:CommonExtensionComponents-2">

<cbc:ProfileID>reporting:1.0</cbc:ProfileID>

<cbc:ID>SME00010</cbc:ID>

<cbc:UUID>8e6000cf-1a98-4174-b3e7-b5d5954bc10d</cbc:UUID>

<cbc:IssueDate>2022-08-17</cbc:IssueDate>

<cbc:IssueTime>17:41:08</cbc:IssueTime>

<cbc:InvoiceTypeCode name="0200000">388</cbc:InvoiceTypeCode>

<cbc:Note languageID="ar">ABC</cbc:Note>

<cbc:DocumentCurrencyCode>SAR</cbc:DocumentCurrencyCode>

<cbc:TaxCurrencyCode>SAR</cbc:TaxCurrencyCode>

<cac:AdditionalDocumentReference>

<cbc:ID>ICV</cbc:ID>

<cbc:UUID>10</cbc:UUID>

</cac:AdditionalDocumentReference>

<cac:AdditionalDocumentReference>

<cbc:ID>PIH</cbc:ID>

<cac:Attachment>

<cbc:EmbeddedDocumentBinaryObject mimeCode="text/plain">NWZlY2ViNjZmZmM4NmYzOGQ5NTI3ODZjNmQ2OTZjNzljMmRiYzIzOWRkNGU5MWI0NjcyOWQ3M2EyN2ZiNTdlOQ==</cbc:EmbeddedDocumentBinaryObject>

</cac:Attachment>

</cac:AdditionalDocumentReference>

<cac:AccountingSupplierParty>

<cac:Party>

<cac:PartyIdentification>

<cbc:ID schemeID="CRN">1010010000</cbc:ID>

</cac:PartyIdentification>

<cac:PostalAddress>

<cbc:StreetName>الامير سلطان | Prince Sultan</cbc:StreetName>

<cbc:BuildingNumber>2322</cbc:BuildingNumber>

<cbc:CitySubdivisionName>المربع | Al-Murabba</cbc:CitySubdivisionName>

<cbc:CityName>الرياض | Riyadh</cbc:CityName>

<cbc:PostalZone>23333</cbc:PostalZone>

<cac:Country>

<cbc:IdentificationCode>SA</cbc:IdentificationCode>

</cac:Country>

</cac:PostalAddress>

<cac:PartyTaxScheme>

<cbc:CompanyID>399999999900003</cbc:CompanyID>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:PartyTaxScheme>

<cac:PartyLegalEntity>

<cbc:RegistrationName>شركة توريد التكنولوجيا بأقصى سرعة المحدودة | Maximum Speed Tech Supply LTD</cbc:RegistrationName>

</cac:PartyLegalEntity>

</cac:Party>

</cac:AccountingSupplierParty>

<cac:AccountingCustomerParty>

<cac:Party>

<cac:PostalAddress>

<cbc:StreetName>صلاح الدين | Salah Al-Din</cbc:StreetName>

<cbc:BuildingNumber>1111</cbc:BuildingNumber>

<cbc:CitySubdivisionName>المروج | Al-Murooj</cbc:CitySubdivisionName>

<cbc:CityName>الرياض | Riyadh</cbc:CityName>

<cbc:PostalZone>12222</cbc:PostalZone>

<cac:Country>

<cbc:IdentificationCode>SA</cbc:IdentificationCode>

</cac:Country>

</cac:PostalAddress>

<cac:PartyTaxScheme>

<cbc:CompanyID>399999999800003</cbc:CompanyID>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:PartyTaxScheme>

<cac:PartyLegalEntity>

<cbc:RegistrationName>شركة نماذج فاتورة المحدودة | Fatoora Samples LTD</cbc:RegistrationName>

</cac:PartyLegalEntity>

</cac:Party>

</cac:AccountingCustomerParty>

<cac:PaymentMeans>

<cbc:PaymentMeansCode>10</cbc:PaymentMeansCode>

</cac:PaymentMeans>

<cac:AllowanceCharge>

<cbc:ChargeIndicator>false</cbc:ChargeIndicator>

<cbc:AllowanceChargeReason>discount</cbc:AllowanceChargeReason>

<cbc:Amount currencyID="SAR">0.00</cbc:Amount>

<cac:TaxCategory>

<cbc:ID schemeID="UN/ECE 5305" schemeAgencyID="6">S</cbc:ID>

<cbc:Percent>15</cbc:Percent>

<cac:TaxScheme>

<cbc:ID schemeID="UN/ECE 5153" schemeAgencyID="6">VAT</cbc:ID>

</cac:TaxScheme>

</cac:TaxCategory>

<cac:TaxCategory>

<cbc:ID schemeID="UN/ECE 5305" schemeAgencyID="6">S</cbc:ID>

<cbc:Percent>15</cbc:Percent>

<cac:TaxScheme>

<cbc:ID schemeID="UN/ECE 5153" schemeAgencyID="6">VAT</cbc:ID>

</cac:TaxScheme>

</cac:TaxCategory>

</cac:AllowanceCharge>

<cac:TaxTotal>

<cbc:TaxAmount currencyID="SAR">30.15</cbc:TaxAmount>

</cac:TaxTotal>

<cac:TaxTotal>

<cbc:TaxAmount currencyID="SAR">30.15</cbc:TaxAmount>

<cac:TaxSubtotal>

<cbc:TaxableAmount currencyID="SAR">201.00</cbc:TaxableAmount>

<cbc:TaxAmount currencyID="SAR">30.15</cbc:TaxAmount>

<cac:TaxCategory>

<cbc:ID schemeID="UN/ECE 5305" schemeAgencyID="6">S</cbc:ID>

<cbc:Percent>15.00</cbc:Percent>

<cac:TaxScheme>

<cbc:ID schemeID="UN/ECE 5153" schemeAgencyID="6">VAT</cbc:ID>

</cac:TaxScheme>

</cac:TaxCategory>

</cac:TaxSubtotal>

</cac:TaxTotal>

<cac:LegalMonetaryTotal>

<cbc:LineExtensionAmount currencyID="SAR">201.00</cbc:LineExtensionAmount>

<cbc:TaxExclusiveAmount currencyID="SAR">201.00</cbc:TaxExclusiveAmount>

<cbc:TaxInclusiveAmount currencyID="SAR">231.15</cbc:TaxInclusiveAmount>

<cbc:AllowanceTotalAmount currencyID="SAR">0.00</cbc:AllowanceTotalAmount>

<cbc:PrepaidAmount currencyID="SAR">0.00</cbc:PrepaidAmount>

<cbc:PayableAmount currencyID="SAR">231.15</cbc:PayableAmount>

</cac:LegalMonetaryTotal>

<cac:InvoiceLine>

<cbc:ID>1</cbc:ID>

<cbc:InvoicedQuantity unitCode="PCE">33.000000</cbc:InvoicedQuantity>

<cbc:LineExtensionAmount currencyID="SAR">99.00</cbc:LineExtensionAmount>

<cac:TaxTotal>

<cbc:TaxAmount currencyID="SAR">14.85</cbc:TaxAmount>

<cbc:RoundingAmount currencyID="SAR">113.85</cbc:RoundingAmount>

</cac:TaxTotal>

<cac:Item>

<cbc:Name>كتاب</cbc:Name>

<cac:ClassifiedTaxCategory>

<cbc:ID>S</cbc:ID>

<cbc:Percent>15.00</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:ClassifiedTaxCategory>

</cac:Item>

<cac:Price>

<cbc:PriceAmount currencyID="SAR">3.00</cbc:PriceAmount>

<cac:AllowanceCharge>

<cbc:ChargeIndicator>true</cbc:ChargeIndicator>

<cbc:AllowanceChargeReason>discount</cbc:AllowanceChargeReason>

<cbc:Amount currencyID="SAR">0.00</cbc:Amount>

</cac:AllowanceCharge>

</cac:Price>

</cac:InvoiceLine>

<cac:InvoiceLine>

<cbc:ID>2</cbc:ID>

<cbc:InvoicedQuantity unitCode="PCE">3.000000</cbc:InvoicedQuantity>

<cbc:LineExtensionAmount currencyID="SAR">102.00</cbc:LineExtensionAmount>

<cac:TaxTotal>

<cbc:TaxAmount currencyID="SAR">15.30</cbc:TaxAmount>

<cbc:RoundingAmount currencyID="SAR">117.30</cbc:RoundingAmount>

</cac:TaxTotal>

<cac:Item>

<cbc:Name>قلم</cbc:Name>

<cac:ClassifiedTaxCategory>

<cbc:ID>S</cbc:ID>

<cbc:Percent>15.00</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:ClassifiedTaxCategory>

</cac:Item>

<cac:Price>

<cbc:PriceAmount currencyID="SAR">34.00</cbc:PriceAmount>

<cac:AllowanceCharge>

<cbc:ChargeIndicator>true</cbc:ChargeIndicator>

<cbc:AllowanceChargeReason>discount</cbc:AllowanceChargeReason>

<cbc:Amount currencyID="SAR">0.00</cbc:Amount>

</cac:AllowanceCharge>

</cac:Price>

</cac:InvoiceLine>

</Invoice>

check the <Invoice …> element

and how to signing with Zatca.Invoice.SDK in C#, make sure you follow @Abdulraouf sugestion to open the xml Document.

For simulation environment, make sure use your Vat Number, Not<cbc:CompanyID>399999999900003</cbc:CompanyID>

1 Like

@eCloud @Abdulraouf @idaoud

idaoud

September 26, 2024, 6:46am

11

Morning @sayedrahman

Thanks for reaching out,

It’s great to hear that your issue resolved now.

Please do not hesitate to reach out for any further assistance.

Thanks,

Dear @idaoud

Thanks in advance

Dear @sayedrahman ,

Yes, each CSID should has its own sequence, so if you changed your device/solution

or even revoked it & onboarded it again, then ICV/PIH should start from the beginning as it’s considered as a new device.

thank you,

anusv

September 27, 2024, 9:34am

14

@sayedrahman Did you got the solution for “invoice hashing errors” ? Appreciating your response

i have same issue. Did you solved? @sayedrahman

@anusv @suhailkk

anusv

September 27, 2024, 4:45pm

17

@sayedrahman we already doing this code but same issue exists.

anusv

September 27, 2024, 5:24pm

19

@sayedrahman Please verify

XmlDocument xDoc = new XmlDocument();

string certificateContent = _strX509Certificate;

SignResult signresult = new SignResult();

HashResult resHash = new HashResult();

FinalJSON Final = new FinalJSON();